Which Raw Materials are Suitable as Physical Assets?

First Steps

Source: Kai Wipperfürth / TRADIUM GmbH

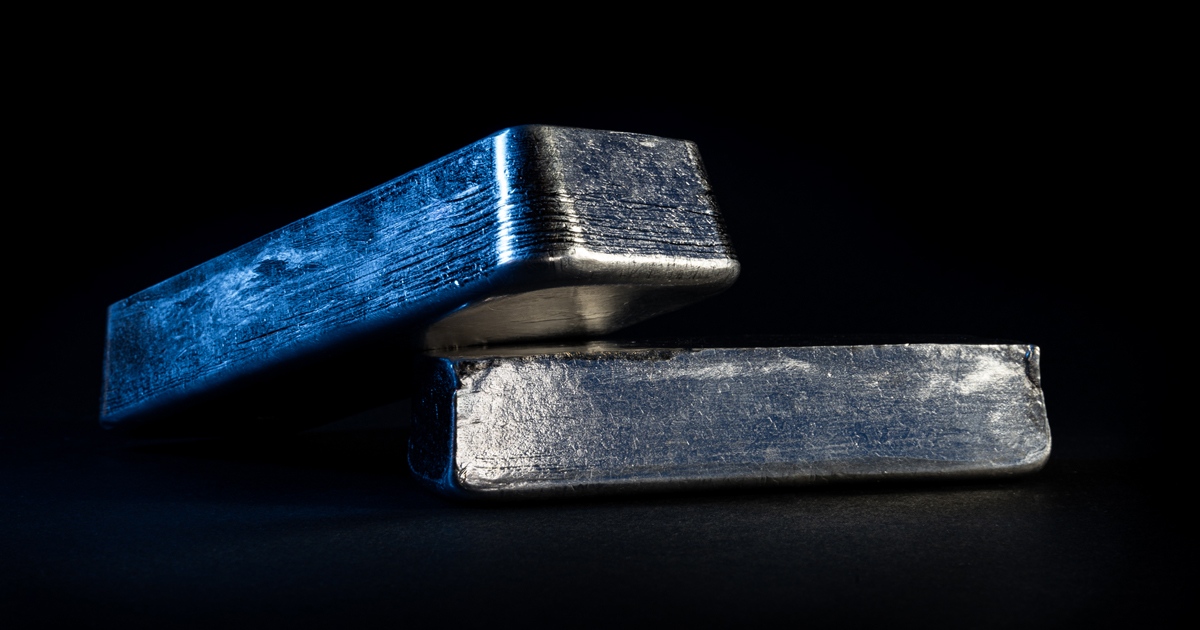

Investing in pyhsical assets does not have to be limited to real estate or works of art. Metallic raw materials can also interest private buyers.

To hedge against inflation or to diversify the portfolio, it is possible to acquire commodities physically. You can choose from energy sources, precious and industrial metals, and agricultural products. The decision should be well considered because some commodities are less practical as physical assets than others.

Wide Range of Raw Materials with a Few Pitfalls

There is a wide range of commodities, from agricultural products through fossil fuels to metals. But only some are suitable as physical assets. Agricultural products such as coffee, cocoa, and wheat cannot be bought and sold practically in quantities that industrial buyers will later need. The short shelf life of agricultural commodities also argues against direct investment. Energy sources such as crude oil or coal also pose challenges for private investors. Hardly anyone has access to the producers nor the warehouses or tanks to store the sometimes hazardous substances. The costs of storage space and transport can also quickly run into money.

Strategic Metals Convince as Physical Values

Strategic metals are in a different situation. Thanks to their physical properties, they can be stored in a small space almost indefinitely. In addition, private buyers have had access to industrial raw materials through specialized suppliers for years. Usually, this includes the possibility of professional storage for small amounts of money. Later, the metals can be resol d to the processing industry. However, the argument of increasing demand for metals from industrialized and emerging countries is likely to weigh the most heavily. Strategic metals are processed in many everyday applications, such as consumer electronics, fiber optic cables, wind turbines, and solar panels. This makes them indispensable for the future of our society, both to maintain our standard of living and create a more sustainable, climate-friendly everyday life. These figures, published by the Statista Research Department, illustrate the industry’s hunger for raw materials. They show the development of demand using the example of rare earths, a raw material group within the strategic metals:

- Wind turbines: global demand of 3,167 tons in 2018 will increase to 11,640 tons in 2040.

- Permanent magnets: global demand will increase from 5,620 tons in 2018 to 20,340 tons.

- E-motors for motor vehicles: demand will explode, growing from 1,930 tons in 2018 to 38,880 tons.

Other application areas and future technologies are steadily being added. In combination with limited availability of raw materials, there are potentially good return opportunities.

These Metals are Suitable as Investments

Private buyers who want to invest money in strategic metals can choose from more than a dozen raw materials. Qualified traders provide access to the aforementioned rare earths and technology metals.

Source: Kai Wipperfürth / TRADIUM GmbH

Among the technology metals, gallium and indium are suitable; the industry requires these to produce photovoltaic modules. Another technology metal is germanium, which is processed together with indium in fiber optic cables.

Another group of raw materials is precious metals, which are important to the industry. Silver, for example, plays an important role as an electrical conductor in electric cars. Platinum, palladium, and rhodium are components in exhaust gas catalytic converters. Iridium will play a key role in the production of green hydrogen and thus contribute to the energy transition.

Those who want to buy one or more of these industrial raw materials and simultaneously avoid unnecessary risks and losses should also take a few tips to heart. Our guide, “Seven Things to Consider When Buying Strategic Metals,” summarizes the most important points.