Despite Interest Rate Turnaround: This is Why Commodities Remain stay Important as Alternative Investment

First Steps

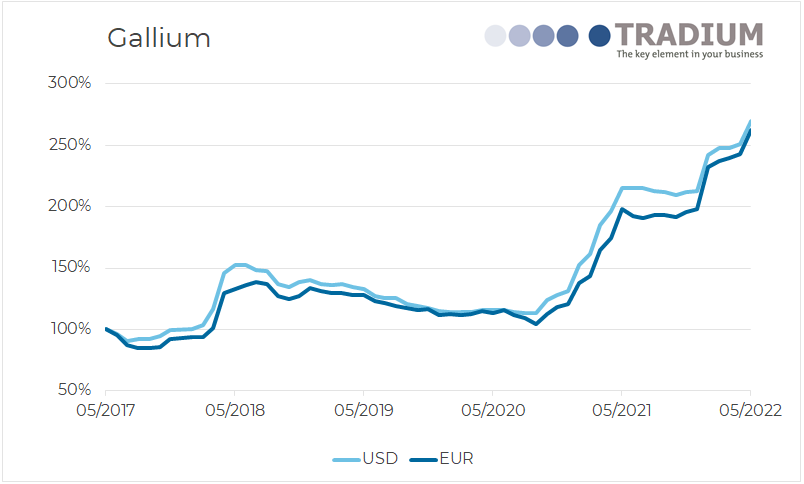

Source: TRADIUM GmbH

The rise in interest rates strengthens bonds and fixed savings. Other forms of investment, such as commodity investments, continue to play a major role in diversifying the portfolio, spreading risk and offsetting inflation.

The Federal Reserve raised the federal funds rate by half a percentage point in May 2022, according to the institution’s protocols. Jerome Powell, head of the Federal Reserve, wants to counter the high inflation rates with this move. The money guardians of the The monetary guardians of the European Central Bank are holding out the prospect of an increase in the key interest rate in July 2022as reported by the Financial Times. This has remained unchanged at zero since March 2016. At the same time, the deposit rate has been negative since June 2014. Banks that place the money they do not need in the short term with the ECB are therefore losing money. These costs are often passed on to customers in deposit fees.

The first banks have announced that they will reduce or abolish these penalty interest rates for customer deposits according to the expected ECB decision. In addition, financial investments such as call money or fixed-term deposits could benefit from the turnaround in interest rates. . Positive returns can also soon be generated again with bonds. Many private investors will take this as an opportunity to adjust their investment strategy. However, they should remember that strong inflation will continue to eat away at their assets.

Real Assets as an Addition to the Portfolio

Inflationary pressure is likely to persist despite initial interest rate hikes. According to the German Federal Statistical Office, the inflation rate in April 2022 was 7.4 percent. This is the highest value since the fall of 1981. The announced interest rate hikes would have to be significantly higher to stop the devaluation of money because of the negative real interest rate. In this situation, broad asset diversification across various assets remains important to minimize downside risks and preserve purchasing power. Therefore, many private investors are adding tangible assets to their portfolios, such as mineral resources, which are in high demand by the economy. Investors who have acquired precious metals, such as gold and silver, can use industrial commodities to further diversify and add to their tangible assets.

Four Reasons for Investing in Commodities

There is a wide range of commodities that the global industry needs. Of these, mineral resources such as technology metals, rare earths and precious metals are interesting to private investors. Innovative investors do not invest in the producers of the raw materials or corresponding ETFs, but prefer tobuy selected mineral resources physically. There are several reasons investors should diversify their assets with commodities:

1. Strong Demand

Industrialized and emerging countries have been experiencing growing demand for raw materials for years. According to a forecast by Statista, demand for rare earths, used in everything from smartphones to e-cars, will increase by 20 percent in the next four years. To invest your money accordingly, you should purchase raw materials in the quality and delivery form required by the industry, so that when you sell them on, they meet the demand of the processing industry.

2. Long-Term Demand

Driven by political and environmental goals such as the European “Green Deal”, the application areas for strategic metals will be strengthened in the coming decades. To achieve the ambitious climate protection goals of the Paris Agreement, for which the milestones are set between 2030 and 2050, the German government is focusing on expanding renewable energy, according to a press release of the German Ministry of Economic Affairs. Dysprosium, neodymium, indium and gallium, as well as the platinum group metals, are indispensable for photovoltaic systems, wind turbines and the promising hydrogen technology. Meanwhile, another declared goal of Germany and many other European countries is self-sufficiency in energy supply. In this way, self-generated wind and solar energy are to replace imported oil and natural gas. Developing the infrastructure required for this will drive the demand for strategic metals for many years to come.

Quelle: TRADIUM GmbH

3. Limited Availability

Deposits of strategic metals are usually concentrated in a few countries. Moreover, mining is costly, and the output is small: Only about 10 tons of the precious metal iridium, which will play a key role in developing clean hydrogen, are produced each year. By way of comparison, the annual production of gold in 2021 was 3,500 metric tons, and 24,000 metric tons for silver. Only a few hundred tons of the technology metal gallium were mined in 2021, according to the U.S. Geological Survey. In 2030, 600 to 800 tons per year are expected to be needed, such as for the photovoltaic industry. The confluence of tight supply and rising demand has caused the price of the technology metal to rise significantly in recent years.

4. Protection Against Inflation and Preservation of Purchasing Power

The intrinsic material value attributed to precious metals, technology metals or rare earths is not subject to money market fluctuations. Therefore, capital investments in strategic metals can protect assets from monetary devaluation. However, to maintain the high quality of industrial goods, which is what makes a resale to processing companies possible in the first place, the ores and minerals must be stored properly.

Thus, investing in raw materials for the industry can offer many advantages and help hedge assets against inflation changes and crises. There is also the prospect of capital appreciation.

Diversification Within Physical Assets Reasonable

In recent years, the range of strategic metals for private purchase has become increasingly diverse. Besides precious metals, technology metals and rare earths can also be purchased and usefully complement the investment mix of stocks, interest-bearing investments and real estate. As with portfolio diversification through commodities, broad diversification is also advisable within tangible asset investments. In this context, it is crucial to make one’s own choice and shape the composition of one’s basket of goods.